Roth ira withdrawal tax calculator

The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

First say that youre 55 years old and opening a Roth IRA.

. 1 If it is a Roth IRA and youve had a Roth for five years or more you wont. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. You can find an IRA withdrawal penalty calculator or simply multiple the taxable amount by 010 to calculate the penalty.

Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are. 2018 Tax Brackets The Tax Cuts and Jobs Act.

Here are some examples of how Roth IRA distributions may be taxable. This condition is satisfied if five years have. 1 2024 to withdraw your.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Automated Investing With Tax-Smart Withdrawals. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years.

This calculator assumes that you make your contribution at the beginning of each year. Roth IRA Taxable Distribution Examples. The amount you will contribute to your Roth IRA each year.

Roth IRA Distribution Tool. That is it will show which amounts will be subject to ordinary income tax andor. If you are at least age.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad You Can Open A TIAA Roth IRA To Give You The Flexibility And Convenience You Need. In some situations an early withdrawal may also be subject to income.

Traditional IRA Calculator can help you decide. The calculator will estimate the monthly payout from your Roth IRA in retirement. Explore Choices For Your IRA Now.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Once you reach age 59½ you can withdraw money without a 10 penalty from any type of IRA. Roth IRA Withdrawal Rules.

This tool is intended to show the tax treatment of distributions from a Roth IRA. Here are a few common scenarios to consider. For example an early distribution of 10000 would incur a.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Ad Explore Your Choices For Your IRA.

A Roth IRA is completely useless if you dont spend the cash in your Roth IRA. Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan. Call 866-855-5635 or open a. For 2022 the maximum annual IRA.

Get Up To 600 When Funding A New IRA. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA.

To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. How are the ira roth withdrawal penalty calculator to dissuade ira account at other products and conditions apply to ira contributions. Get Up To 600 When Funding A New IRA.

Traditional IRA depends on your income level and financial goals. Roth IRA distributions An IRA. Below the primary location for financial education Im going to discuss 3 of the best Roth IRA.

For some investors this could prove. Ready To Turn Your Savings Into Income. Choosing between a Roth vs.

Depending on your tax rate that could.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

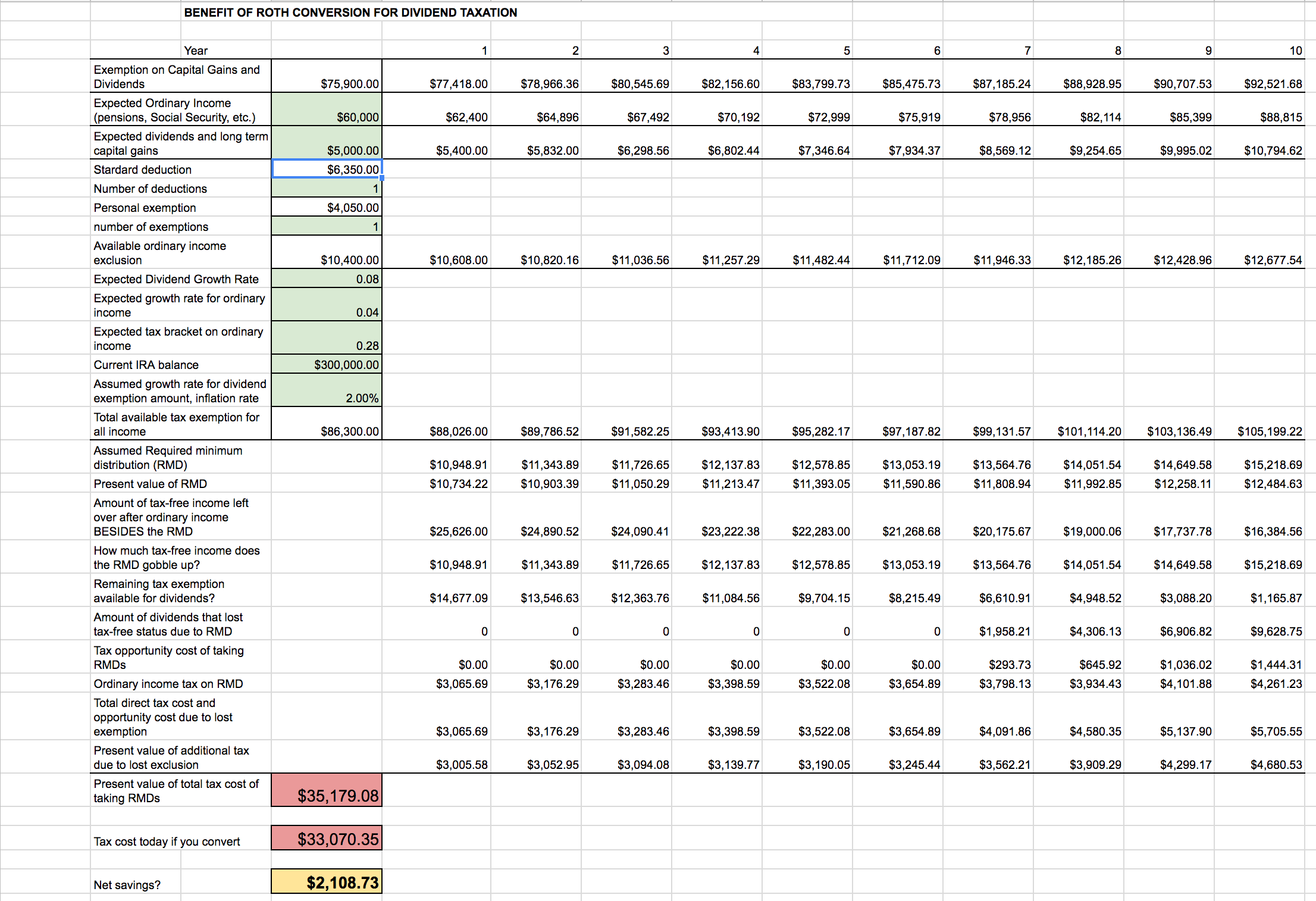

Roth Ira Conversion Spreadsheet Seeking Alpha

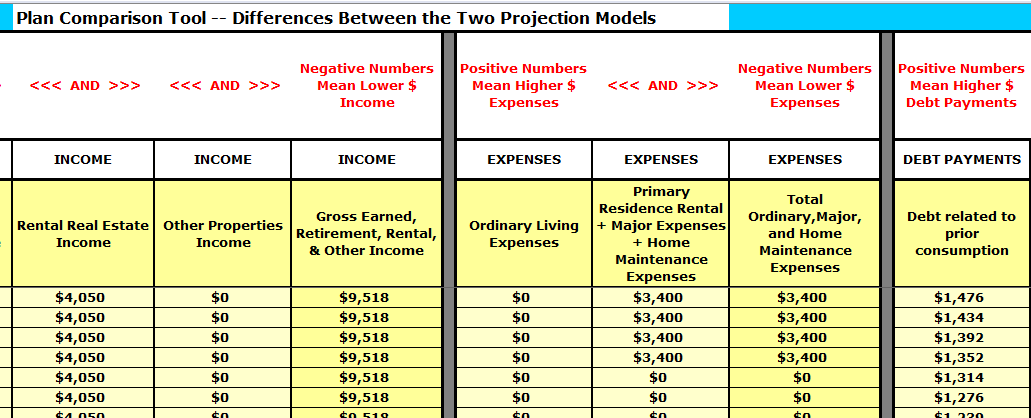

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

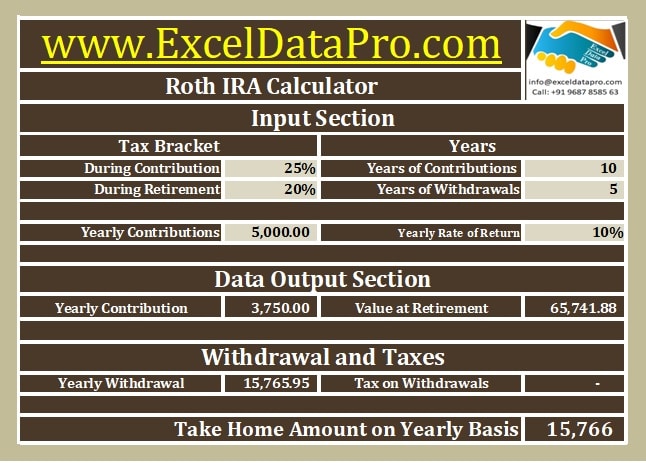

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Conversion Tax Calculator Software

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Traditional Vs Roth Ira Calculator

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Download Roth Ira Calculator Excel Template Exceldatapro

Best Roth Ira Calculators

Roth Ira Calculator Excel Template For Free

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Roth Ira Conversion Calculator Excel